In today’s rapidly evolving digital landscape, tokenization is redefining how we secure, own, and trade assets. At its core, tokenization is the process of converting ownership rights or sensitive data into digital tokens, typically secured on blockchain or other secure platforms. These tokens act as digital representations of real-world or digital assets, from real estate to sensitive financial data, unlocking unprecedented opportunities for security, liquidity, and accessibility.

Tokenization is more than a technological trend—it’s a transformative force reshaping finance, cybersecurity, and asset management. From enabling fractional ownership of high-value assets to safeguarding sensitive information, tokenization is driving efficiency and inclusivity across industries. This article dives deep into the mechanics, benefits, applications, and future of tokenization, offering actionable insights for professionals, investors, and business leaders eager to navigate the digital economy.

Whether you’re a tech enthusiast, a financial professional, or a business owner, understanding tokenization is key to staying ahead in a world where digital assets are becoming the norm. Let’s explore how tokenization is revolutionizing asset security, ownership, and liquidity.

Understanding Tokenization

What Is Tokenization?

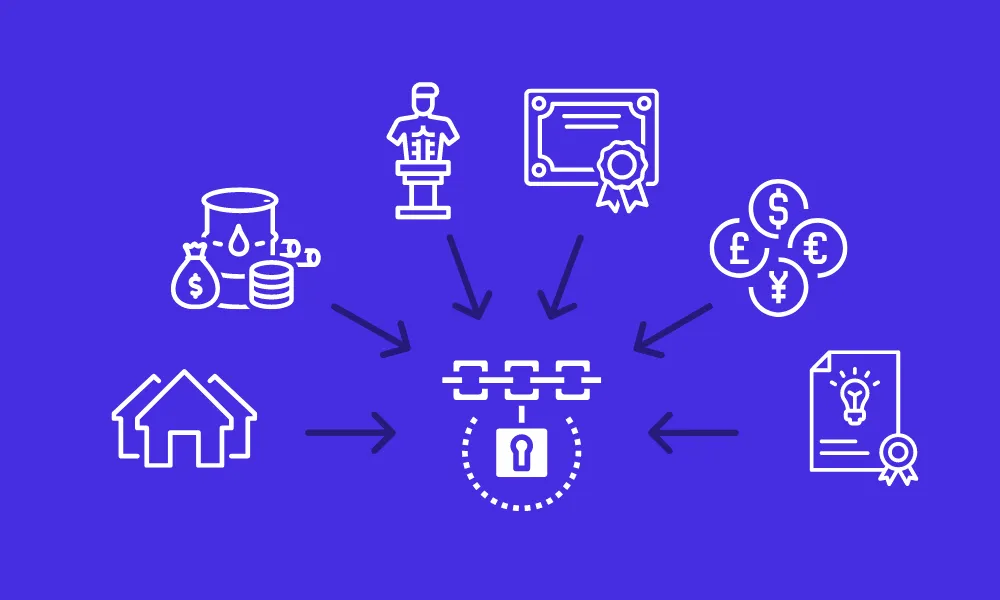

Tokenization is a versatile concept with two primary applications: data tokenization for security and asset tokenization for ownership. Data tokenization replaces sensitive information—like credit card numbers or personal data—with unique, non-sensitive tokens that are meaningless outside their specific system. Asset tokenization, on the other hand, converts ownership rights to physical or digital assets into digital tokens on a blockchain, enabling seamless trading and fractional ownership.

For example, tokenizing a $1 million property allows investors to purchase fractional shares as tokens, making real estate investment accessible to a broader audience. Other tokenized assets include stocks, commodities, intellectual property, and even digital art, such as NFTs (non-fungible tokens). Tokens generally fall into three categories:

- Security Tokens: Represent ownership in assets like stocks or real estate, subject to regulatory oversight.

- Payment Tokens: Facilitate secure transactions, like tokenized credit card data in digital payments.

- Utility Tokens: Grant access to specific services or platforms, often used in decentralized applications.

Understanding these distinctions is crucial for grasping tokenization’s broad impact across industries.

How Tokenization Works

Tokenization involves creating digital tokens that represent either sensitive data or asset ownership. Here’s a simplified breakdown of the process:

- Asset or Data Identification: The process begins by identifying the asset (e.g., a property or financial data) to be tokenized.

- Token Creation: A digital token is generated, often on a blockchain platform like Ethereum, using smart contracts—self-executing agreements that automate transactions and ensure compliance.

- Storage and Security: For data tokenization, the original data is securely stored in a vault, while the token is used in transactions. For asset tokenization, ownership details are recorded on the blockchain, ensuring transparency and immutability.

- Token Utility: Tokens can be traded, redeemed, or used within their designated ecosystem. For example, a tokenized property share can be traded on a secondary market.

- Detokenization: In data tokenization, authorized parties can reverse the process (detokenization) to access the original data. In asset tokenization, tokens can be redeemed for the underlying asset or its value.

Smart contracts play a pivotal role by automating processes like ownership transfers, dividend payments, or regulatory compliance, reducing manual intervention and errors.

Benefits of Tokenization

Tokenization offers a multitude of advantages, making it a game-changer for businesses, investors, and consumers. Here’s how it transforms security, liquidity, efficiency, and access.

Enhanced Security and Privacy

Tokenization significantly reduces the risk of data breaches by replacing sensitive information with tokens that are useless to hackers. For instance, in payment processing, a credit card number might be replaced with a random token, rendering stolen data ineffective outside the system. This is particularly valuable for compliance with regulations like PCI DSS (Payment Card Industry Data Security Standard), HIPAA (Health Insurance Portability and Accountability Act), and GDPR (General Data Protection Regulation).

By minimizing the exposure of sensitive data, tokenization reduces the impact of breaches, protecting businesses and customers alike. For example, a 2024 report by IBM Security noted that data breaches cost companies an average of $4.88 million globally—tokenization can mitigate these risks by ensuring sensitive data is never directly exposed.

Increased Liquidity and Market Efficiency

Tokenization unlocks liquidity in traditionally illiquid assets, such as real estate or private equity, by enabling fractional ownership. Instead of needing millions to invest in a commercial property, investors can buy tokenized shares for as little as $100, democratizing access to high-value markets.

Global secondary markets, powered by blockchain, allow 24/7 trading of tokenized assets, bypassing traditional market hours and geographic restrictions. Additionally, blockchain’s real-time transaction processing reduces settlement times from days to minutes, enhancing market efficiency. For instance, tokenized securities can settle almost instantly, compared to the T+2 (trade date plus two days) settlement in traditional markets.

Cost Reduction and Operational Efficiency

By leveraging blockchain and smart contracts, tokenization eliminates intermediaries like brokers, custodians, and clearinghouses, reducing transaction fees. For example, real estate transactions typically involve multiple parties and high costs—tokenization streamlines this process, cutting fees by up to 50% in some cases.

Transparency and Trust

Blockchain’s immutable and decentralized nature ensures that every transaction and ownership record is transparent and verifiable. This fosters trust among investors and consumers, who can trace the history of a tokenized asset or verify the security of tokenized data. For example, a tokenized artwork’s provenance can be tracked on the blockchain, ensuring authenticity and preventing fraud.

This transparency is particularly valuable in industries plagued by mistrust, such as art or supply chain management, where verifying authenticity is critical.

Broadened Access to Diverse Asset Classes

Tokenization lowers barriers to entry, allowing investors to participate in niche or high-value markets. Assets like fine art, collectibles, intellectual property, or corporate bonds, once reserved for the ultra-wealthy, are now accessible through fractional ownership. For instance, platforms like Masterworks allow investors to buy shares in tokenized artworks by Picasso or Banksy for as little as $20.

This democratization extends to emerging markets, where tokenization enables global investors to access assets in regions with limited financial infrastructure.

Applications and Use Cases of Tokenization

Tokenization’s versatility spans financial and non-financial sectors, driving innovation across industries. Here are some key applications.

Tokenization in Financial Markets

In financial markets, tokenization is revolutionizing how stocks, bonds, and commodities are traded. Security tokens, backed by real-world assets, offer a regulated way to invest in capital markets. For example, tokenized bonds issued by companies like Societe Generale in 2023 demonstrate how blockchain can streamline issuance and trading while ensuring compliance.

Tokenized securities also enable 24/7 global trading, bypassing traditional exchange limitations. This is particularly impactful in emerging markets, where access to capital markets is often restricted.

Blockchain and Digital Payments

In e-commerce and digital payments, tokenization safeguards cardholder data by replacing it with tokens during transactions. For example, when you pay with a credit card on a tokenized platform like Apple Pay, your card number is never shared with the merchant, reducing fraud risk. A 2024 Visa study reported that tokenized payments reduced fraud by 60% in online transactions.

This application is critical for businesses seeking to build customer trust and comply with PCI DSS standards.

Non-Financial Applications

Tokenization extends beyond finance into diverse sectors:

- Real Estate: Platforms like RealT enable fractional ownership of properties, allowing investors to buy tokens representing shares in rental income or property value.

- Intellectual Property: Musicians and artists tokenize royalties or copyrights, enabling fans to invest in future earnings. For example, platforms like Royal allow artists to sell tokenized song royalties.

- Emerging Use Cases: In insurance, tokenized policies streamline claims processing. In global trade, tokenized supply chain assets enhance transparency and efficiency. In entertainment, tokenized tickets prevent scalping and ensure authenticity.

Implementation Considerations

While tokenization offers immense potential, implementing it requires careful planning to address technical and regulatory challenges.

Technical and Regulatory Challenges

- Regulatory Compliance: Tokenized assets, especially security tokens, must comply with jurisdictional regulations like SEC rules in the U.S. or MiFID II in Europe. Cross-border transactions add complexity, requiring adherence to varying KYC and AML standards.

- Security Risks: While blockchain is secure, vulnerabilities in smart contracts or tokenization platforms can lead to hacks. The 2023 Ronin Network hack, where $600 million in tokens was stolen, underscores the need for robust security measures.

- Operational Challenges: Integrating tokenization with legacy systems can be complex, requiring significant investment in infrastructure and training.

Best Practices for Successful Tokenization

- Choose the Right Platform: Select blockchain platforms like Ethereum, Polygon, or Tezos based on scalability, cost, and regulatory support. For example, Ethereum’s ERC-20 standard is widely used for security tokens.

- Integrate with Legacy Systems: Use APIs to connect tokenized assets with existing financial or data management systems, ensuring a seamless user experience.

- Prioritize Scalability and Accessibility: Design tokenization frameworks that scale with demand and are user-friendly for non-technical investors.

Future Trends and Innovations

Tokenization is poised to shape the future of global markets. Key trends include:

- Decentralized Finance (DeFi): DeFi platforms are integrating tokenization to create complex financial instruments, such as tokenized derivatives or yield farming assets.

- Institutional Adoption: Major financial institutions, like JPMorgan and Goldman Sachs, are exploring tokenization for private equity and debt instruments, signaling mainstream acceptance.

- Global Market Evolution: By 2030, the tokenized asset market is projected to reach $16 trillion, according to a 2024 Boston Consulting Group report, driven by growing demand for liquid, accessible assets.

Conclusion

Tokenization is a transformative force, revolutionizing how we secure data, own assets, and access markets. By enhancing security, increasing liquidity, reducing costs, and broadening access, it empowers businesses and investors to thrive in the digital economy. From fractional real estate ownership to secure digital payments, tokenization’s applications are vast and growing.